How Do I Get A 501c3 Determination Letter

How do I get a copy of my 501c3 determination letter. Getting a 501c3 Determination Letter After applying with the IRS for 501c3 status it may take between 3 and 6 months to get a determination letter confirming approval.

Real Estate Offer Letter Unique Simple Letter Templates 47 Free Word Pdf Doc Printable Letter Templates Business Letter Example Free Printable Letter Templates

In other words there is no expiration date on a 501c3 organization.

How do i get a 501c3 determination letter. How to Get a Copy of IRS Determination Letter of 501 C 3 Finding the Determination Letter Online. A ruling or determination letter will be issued to your organization if its application and supporting documents establish that it meets the particular requirements of the section under which it is claiming exemption. What is IRS 501c3 determination letter.

We dont accept telephone or email requests. Once you pay the fee you can simply download a copy of your IRS 501 c 3 determination letter to your computer and print it at any time. Applying for Tax-Exempt Status.

If you ever need to replace your 501 c 3 letter IRS Form 4506-A instructions provides a way to get a copy of your original determination letter. If you find that the printed quality of the online IRS entity status letter is not good enough. This form is primarily used by members of the public to inspect copies of exempt organizations applications for exempt status.

Exempt status we have determined that you are exempt from Federal income tax under section 501 c 3 of the Internal Revenue Code. It may take 60 days or longer to process your request. If everything is in order and your organization meets all IRS requirements you will receive a determination letter approving your application and stating that you have 501c3 status.

This may be the best option if you frequently misplace your determination notice or need to print copies often. These procedures do not apply to requests for a copy of a tax-exempt. You can get a copy of your original determination letter for your retirement plan or request a correction to the letter by mail or fax.

The affirmation letter takes 10-14. If your nonprofit has misplaced your 501 c determination letter for the IRS you can get a copy of an affirmation letter to have proof of your tax-exempt status. Procedures for issuing rulings and determination letters regarding tax-exempt status under Code section 501a other than section 501c3 A ruling or determination letter will be issued to your organization if its application and supporting documents establish that it meets the particular requirements of the section under which it is claiming exemption.

Once youve obtained 501c3 status you do not need to file any kind of document to renew the application. Procedures for issuing rulings and determination letters regarding tax-exempt status under Code section 501a. If youre not sure if your nonprofit has 501c3 tax-exempt status click here.

Apr 30 2021 How do I get a copy of my 501c3 determination letter. 855-204-6184 A copy of a return report or notice see Copies of Exempt Organization Returns are Available. Complete and submit Form 4506-A to the IRS to request a copy of an original 501 c 3 determination letter.

You may also request an affirmation letter. After an agent determines the organizations exempt status it may issue an affirmation letter. How can I get a copy of my organizations exemption letter.

Instead of the form you also may submit a written letter that includes the nonprofits name and EIN as well as your contact information. How do I get a copy of my 501c3 determination letter. Box 2508 Room 6403 Cincinnati OH 45201 EEFax.

As far as the IRS is concerned the simple answer is. You can get a copy of the determination letter by submitting form 4506-A as prior counsel advised. Until you have this letter you cannot operate as a tax-exempt nonprofit.

Fax or mail the request to the IRS. Call the IRS Customer Service for nonprofit organizations at 1-877-829-5500 and give them your nonprofits name and Employer Identification Number EIN. Because you might want to give the 501 c 3 letters to donors as part of.

You can download copies of original determination letters issued January 1 2014 and later using our on-line search tool Tax Exempt Organization Search TEOS. The amount of time you can expect depends on the scale of the operation. You can also get an affirmation letter from the IRS by contacting IRS Customer Account Services at 877-829-5500.

You can send your request by fax to 855-204-6184 or by mail to. Call the IRS Customer Service for nonprofit organizations at 1-and give them your nonprofits name and Employer Identification. Contributions to you are deductible under section 170 of the Code.

Verified 6 days ago. You are also qualified to receive tax deductible bequests devises transfers or gifts under section 2055 2106 or 2522 of the Code. To otherwise receive a copy of the original determination letter submit a request using Form 4506-A or in a letter containing the name and employer identification number of the organization along with the name address and phone number of the requester.

Updated Determination Letter includes all supporting documents Internal Revenue Service Attn. If your nonprofit has misplaced your 501 c determination letter for the IRS you can get a copy of an affirmation letter to have proof of your tax-exempt status. Do not submit a copy of your original EP determination letter application with your request.

Donation Thank You Letter Slip Sample Giving Charity Auction Determination Donation Thank You Letter Donation Letter Donation Request Letters

25 Grant Proposal Sample Pdf Happydewaliimages Template Business Proposal Letter Proposal Letter Business Proposal Sample

The New Pmi Symbol Meanings Meant To Be Symbols Innovation

501c3 Determination Letter Animal League

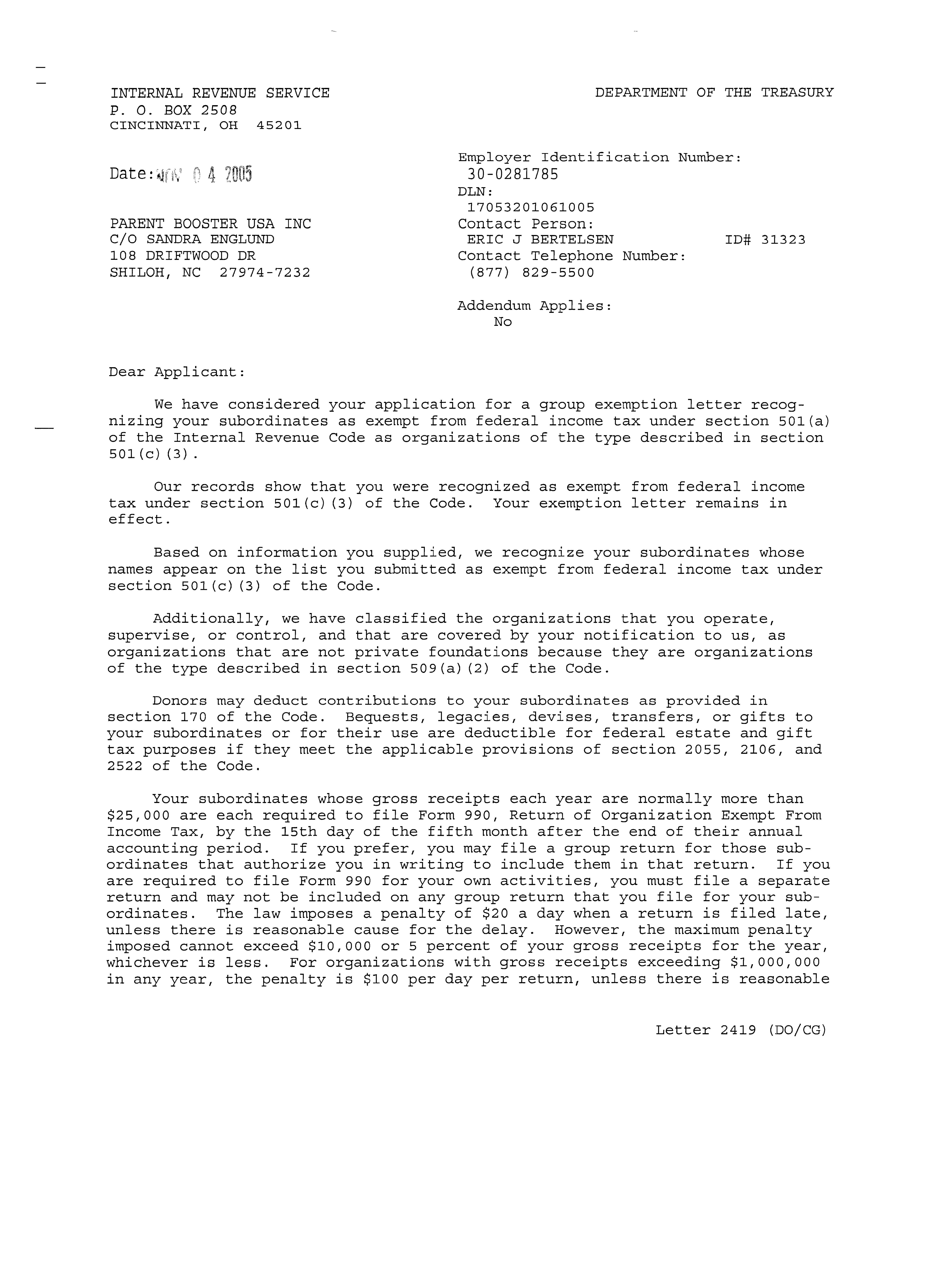

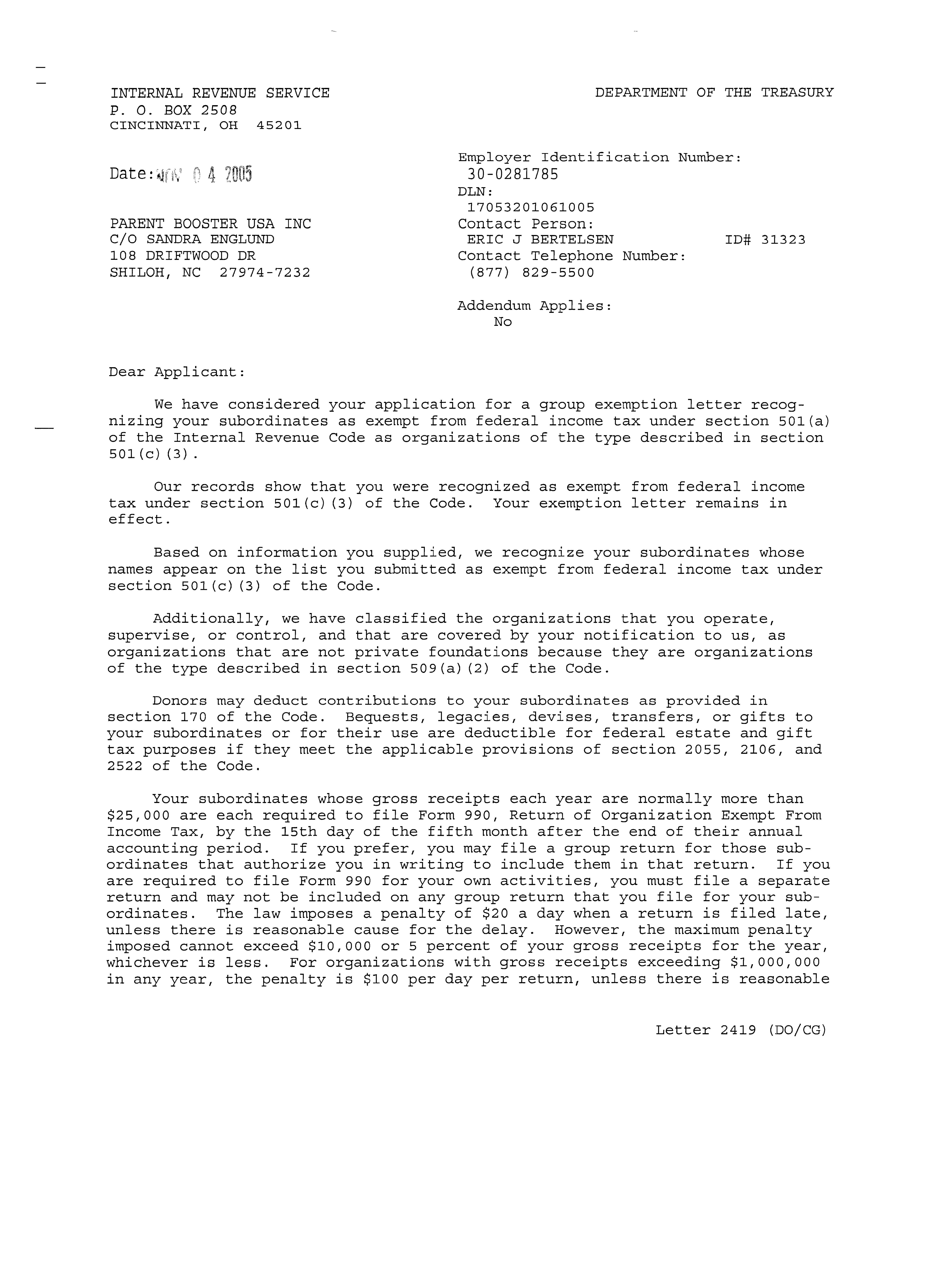

501 C 3 Group Exemption Letter Parent Booster Usa

Collection Letters To Clients Luxury Collections Letter To Client Unique Professional Cover Letter Template Doctors Note Template Simple Cover Letter Template

Attorney Client Letter Template Inspirational Best S Of Client Opinion Letter Sample Virginia Letter Templates Lettering Cv Template Word

Have You Lost Your 501c Determination Letter

How To Start A Non Profit Organization In Pennsylvania Paperwork Cost And Time Http Localhost Inform Start A Non Profit Non Profit Nonprofit Organization

Get Our Sample Of Bond Claim Letter Template For Free Letter Templates Lettering Letter Example

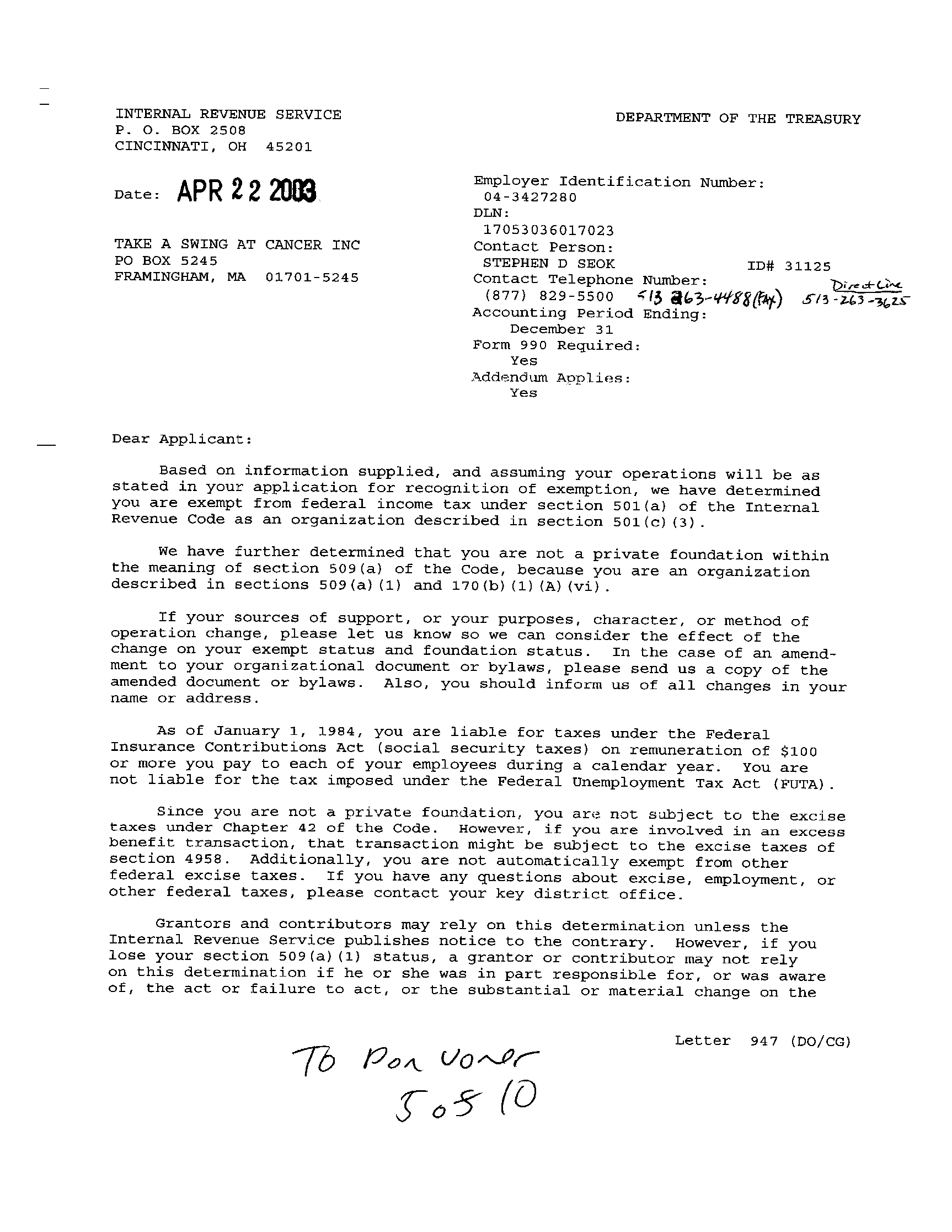

Organic Torah 501c3 Determination Letter Organic Torah

Exemption Application User Fee Maritime Research Sources Internal Revenue Service

How To Work As A Nonprofit Until You Get Your 501 C 3 Status How To Get Money Non Profit Business Basics

501c3 Determination Letter Animal League

File Tasc 501c3 Letter Png Wikipedia

Merlin 501 C 3 Irs Determination Letter

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

What Is A 501 C 3 Determination Letter Legalzoom Com

Is Your Brand Greenwashing Why Brand Alignment Matters Nonprofit Marketing Marketing Technology Nonprofit Management

Posting Komentar untuk "How Do I Get A 501c3 Determination Letter"