How Much Does A Letter Of Credit Cost

Minimum letter of credit issuance cost to the importer for this example is 625 Euro. How much does it cost for a letter of credit.

Letter Of Credit Explained With Process Example Drip Capital

Some fees are assumed by the seller others by the buyer.

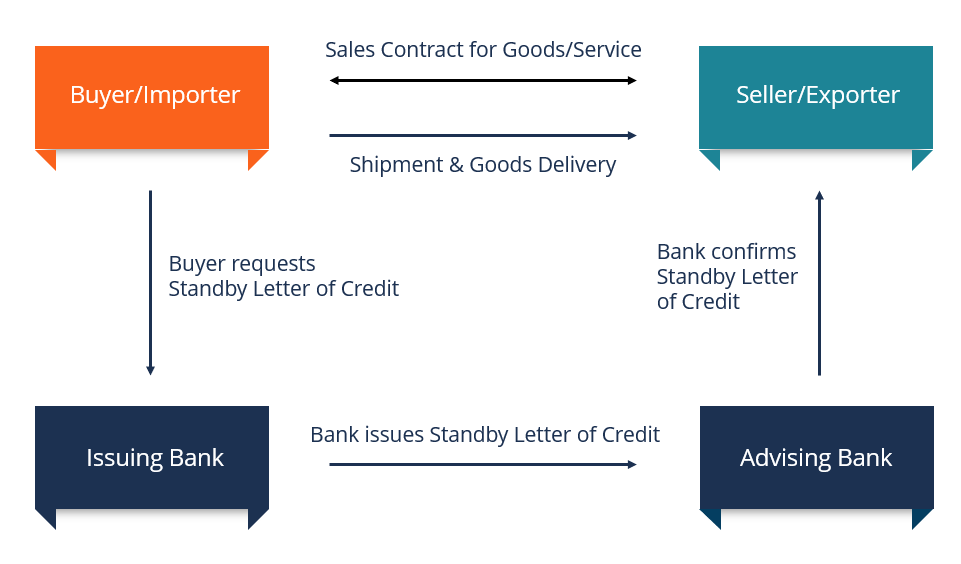

How much does a letter of credit cost. An SBLC acts as a safety net for the payment of a shipment of physical goods or completed service to the seller in the event something unforeseen prevents the buyer from making the scheduled payments to. Letters of credit are used extensively in the financing of international trade when the reliability of contracting parties cannot be readily and easily determined. Letter of credit amount is 100000 Euro and the time between the issuance of the letter of credit and the payment to the exporter is 3 months.

But the cost may vary from 025 to 2 depending on various other factors. A letter issued from the bank or any reputed financial institution stating that the buyers payment to a seller will be sentreceived on the determined time for the set payment is known as a Letter of Credit. The exporter and their bank must be satisfied with the creditworthiness of the importers bank.

Usually the cost may include bank commission processing fee swift charges. On this post you can find detailed explanation in regards to letter of credit fees. Letters of credit normally cost 1 of the amount covered in the contract.

We regularly hear from internationally trading companies who are shocked by the level of letter of credit charges being deducted by UK based advising or confirming banks. Letters of Credit Cost The cost of a Letters of Credit may vary based on the amount its tenure. Can a letter of credit be cancelled.

This amount is typically no more than a few percentage points but itll depend on variables like your credit history. The letter of credit is issued in irrevocable format and all fees outside of the Germany will be paid by the exporter. Such as advising fee amendment fee confirmation fee discrepancy fee handling fee issuance fee and reimbursement fee etc.

The bank you use will decide on costs. In the current global financial climate many internationally trading companies are turning to letters of credit as a means of securing payment from buyers in new or difficult markets. Letter of Credit Draw Fee A processing fee of 250 will be charged by the Bank for each individual draw request on a Letter of Credit.

One LC management company proposes that for LCs in excess of 100000 a typical buyers fee is 075 percent but notes that in. Fees for different kinds of. The Importers bank drafts the Letter of Credit using the Sales Agreement terms and conditions and transmits it to the exporters bank.

Ask your bank for details however in most cases the management of a letter of credit might cost a few hundred dollars per year. Irrevocability fee 200 Euro Issuance of a letter of credit fee. The charges are taken for a rnage of reasons such as SWIFT messages chasers holding documents etc.

The fee structure isnt straightforward to explain. The cost of opening a letter of credit varies from country to country as a rule of thumb the exporter can estimate that in most developed nations the percentage cost for opening and paying a letter of credit will be 34 for letters of credit in excess of 100000 minimums will vary from bank to bank. Once the Sales Agreement is completed the importer applies to their bank to open a Letter of Credit in favor of the exporter.

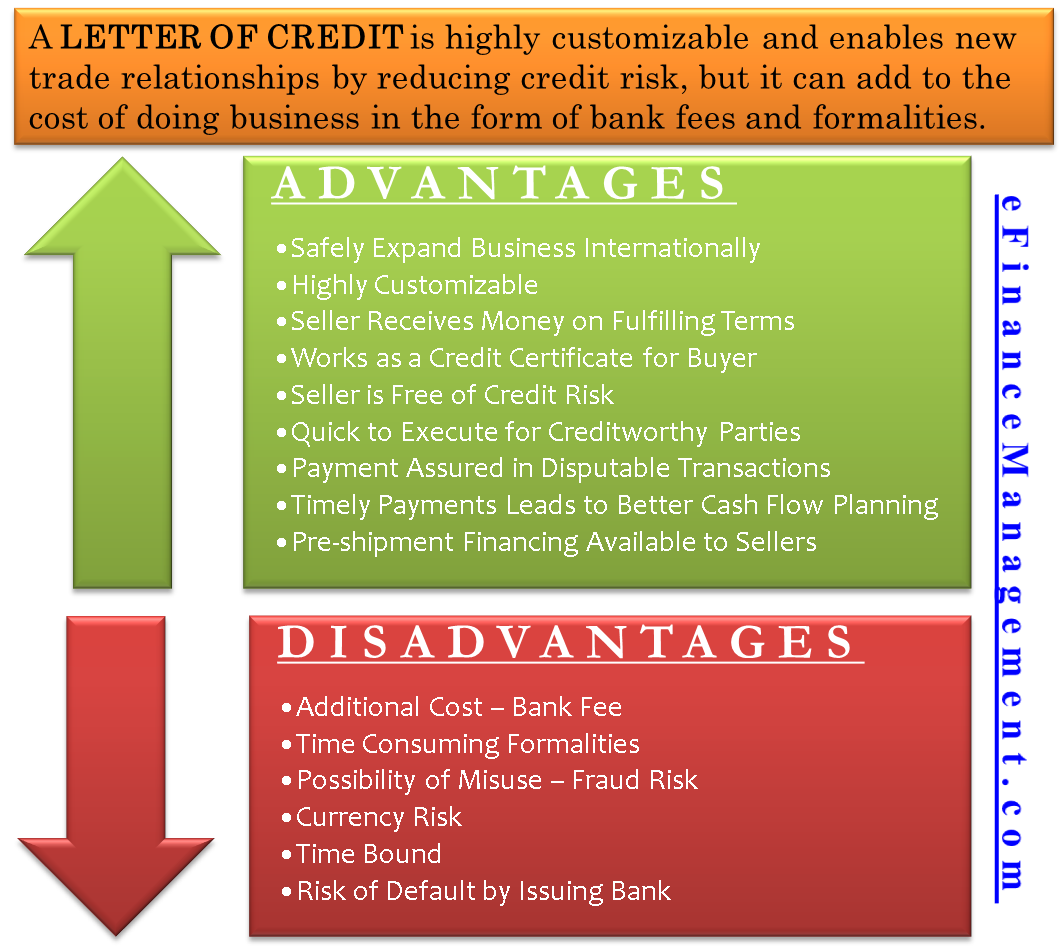

Letters of credit have certain advantages as an international payment method. Think of it as kind of a bank loan that never gets used unless you default on rent payments. In most cases letters of credit are irrevocable and cannot be cancelled without the agreed consent of all parties.

A standby letter of credit abbreviated as SBLC refers to a legal document where a bank guarantees the payment of a specific amount of money to a seller if the buyer defaults on the agreement. Our popular Letter. Typical charges range from 3000 6000.

How to Apply for a Letter of Credit. There isnt a set fee for letters of credit. Often in international trade a letter of credit is used to signify that a payment will be made to the seller on time and in full as guaranteed by a bank or financial institution.

The most vague of all LC charges these are often deducted by non-UK banks usually the London based correspondent of the issuing bank. Further the cost is borne by the Applicant buyer. There are ample types of LOC and.

Often regarded as a facility by a bank the chosen respective bank will bear the entire or partial cost if the buyer is unable to make the payment of the purchase. What would it be the approximate cost of an LC Letter of Credit Documentary Credit for a transaction of 15000. A letter of credit also known as a documentary credit or bankers commercial credit or letter of undertaking is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods.

The exporters bank reviews and approves the Letter of Credit. How much does a letter of credit cost. Can a letter of credit be discounted.

You can expect to be charged some percentage of the amount covered by the letter of credit. A letter of credit is not free. Banks will charge some sort of fee which is tied to the credit amount.

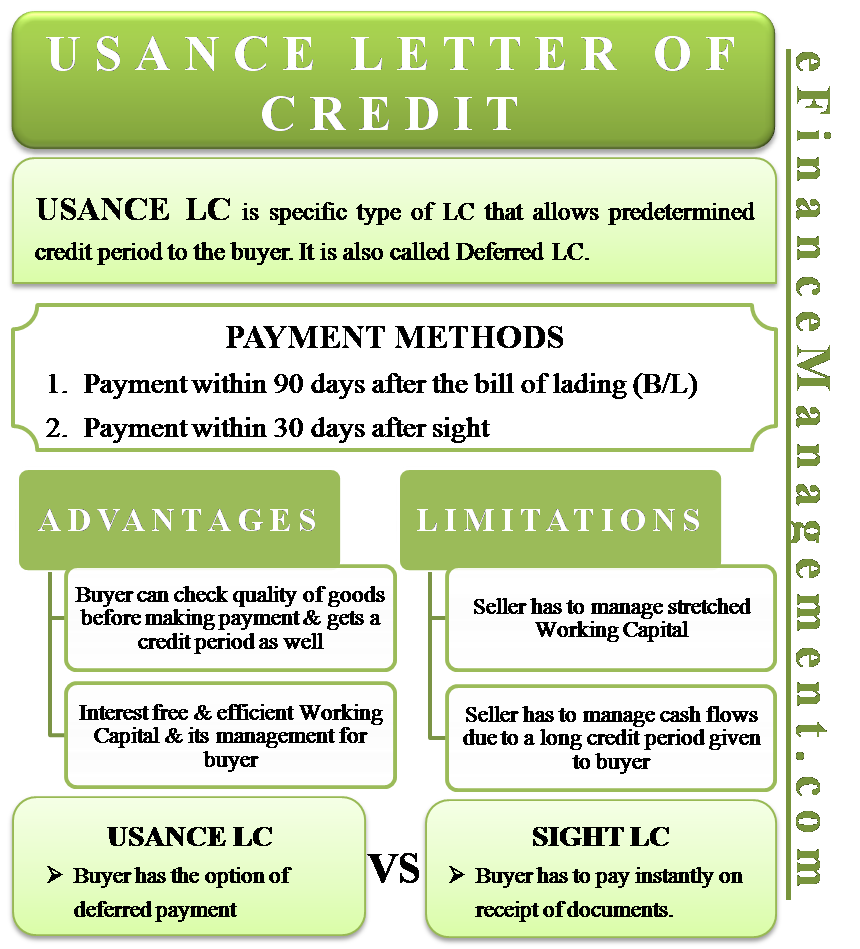

Usance Letter Of Credit Meaning Example Sight Vs Usance

Letter Of Credit Explained With Process Example Drip Capital

10 Sample Letter Of Credit Format Template And Examples Of Letter Of Credit A Plus Topper

Letter Of Credit Mechanism Process Money Management Advice Money Management Budgeting Finances

Letter Of Credit Explained With Process Example Drip Capital

Letter Of Credit Guide Types Process Example

Letter Of Credit Explained With Process Example Drip Capital

Infographics Letter Of Credit Vs Bank Guarantee Mt700 Vs Mt760 Trade Finance Finance Lettering

Letter Of Credit Guide Types Process Example

Standby Letter Of Credit Sblc Overview How It Works Types

Letter Of Credit Explained With Process Example Drip Capital

10 Sample Letter Of Credit Format Template And Examples Of Letter Of Credit A Plus Topper

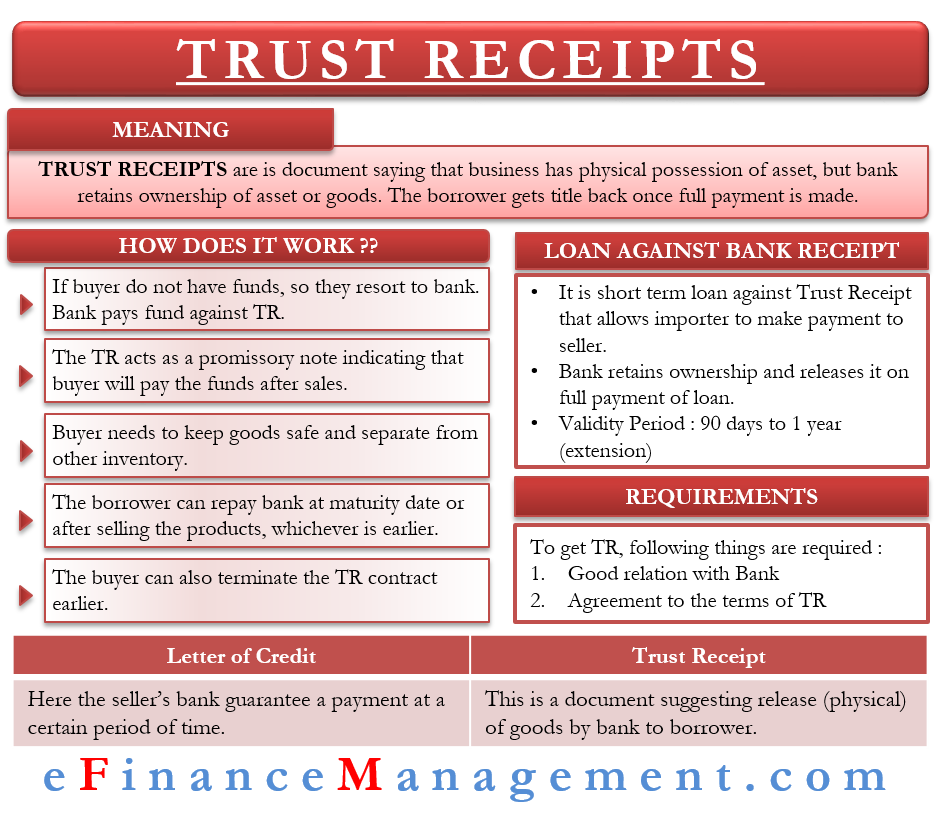

Trust Receipt What It Is And How It Works

Letter Of Credit Explained With Process Example Drip Capital

10 Sample Letter Of Credit Format Template And Examples Of Letter Of Credit A Plus Topper

10 Sample Letter Of Credit Format Template And Examples Of Letter Of Credit A Plus Topper

:max_bytes(150000):strip_icc()/running-over-the-terms-and-conditions-in-her-contract-888776672-b0214fd88f4049a697fb91257430913d.jpg)

Posting Komentar untuk "How Much Does A Letter Of Credit Cost"